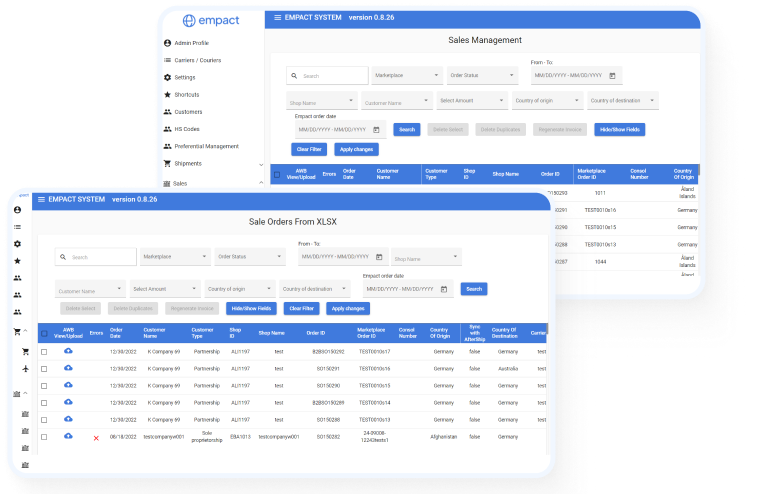

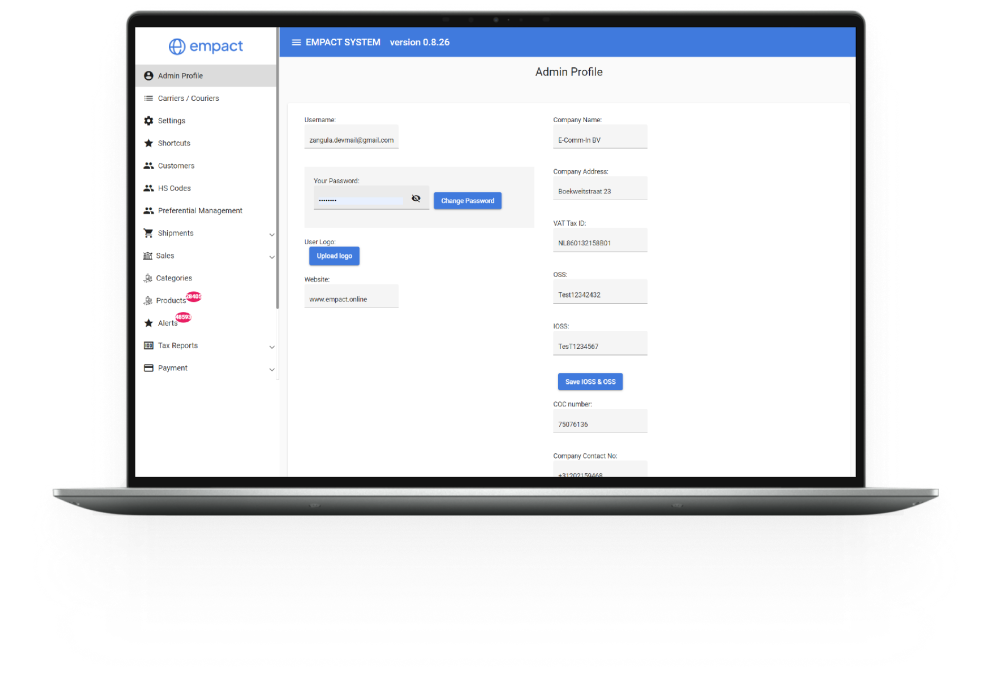

Empact is the leading provider of innovative European Union VAT solutions that make it easy for businesses of all sizes to comply with the complex and ever-changing tax rules.Through Empact, businesses will be able to easily and quickly calculate their VAT taxes, reducing administrative costs and ensuring compliance with all European Union regulations. Sellers are empact’s customers they get themselves registered with e-commerce website and shop name,Empact fetches all the delivery sellers to UK.

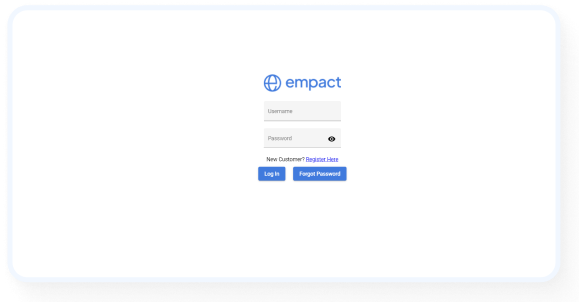

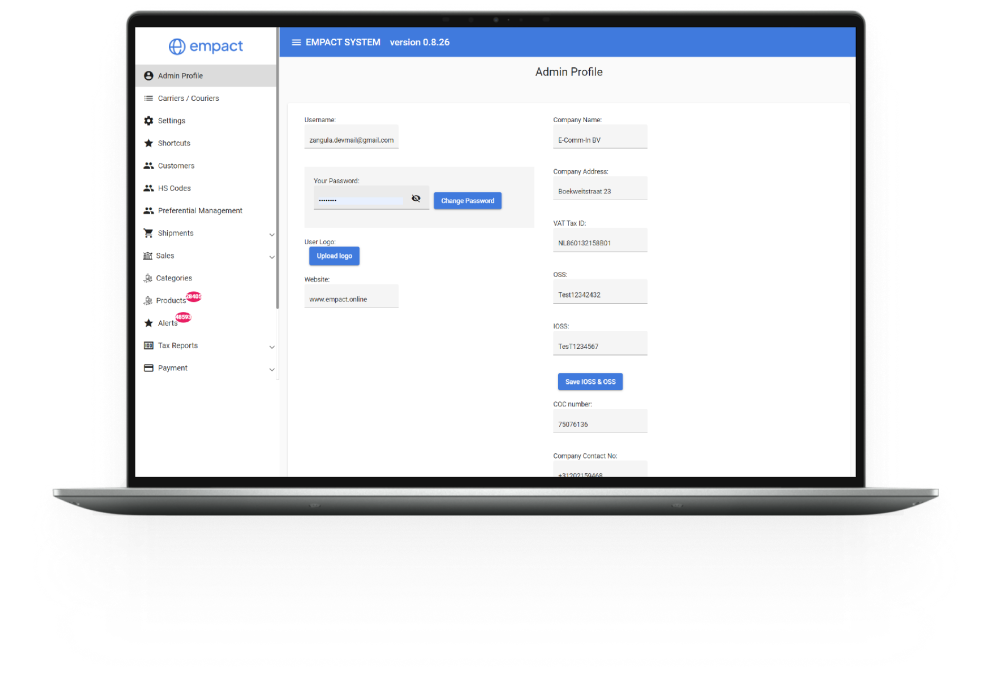

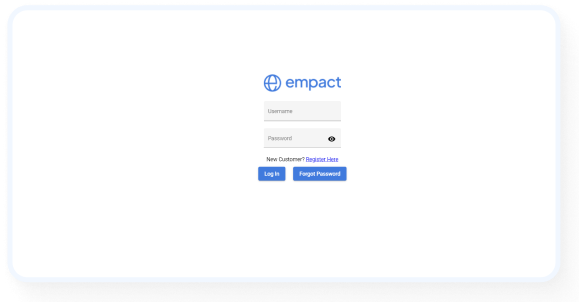

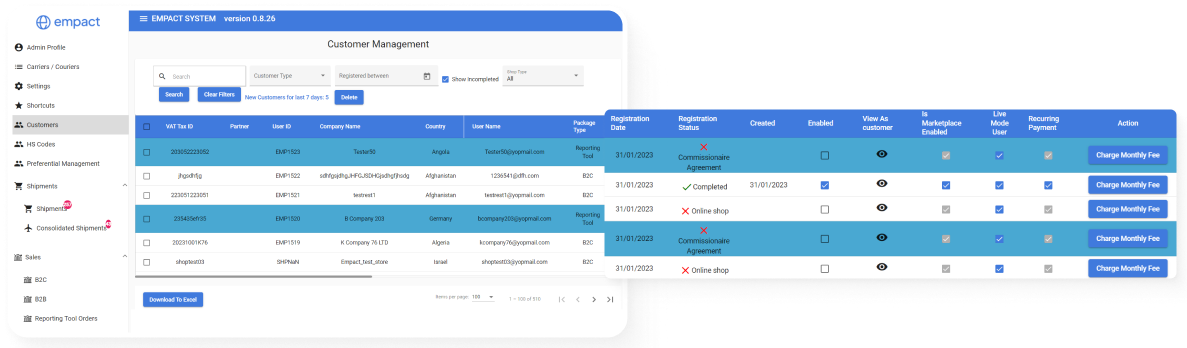

The Admin logs in the system with user name (email format) and password.There is one Admin user in the system.Any customer registered in the system can login with username and password.First time users can register themselves by clicking on ‘Register Here”,after that they have to select the type of their business that is an online,offline or independent VAT number.

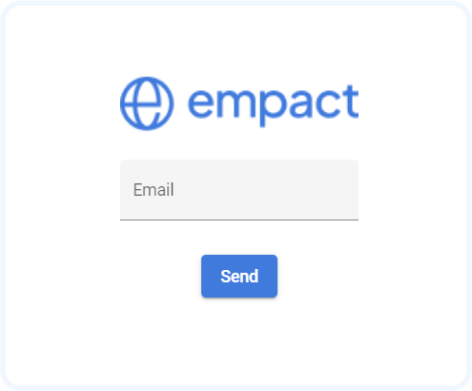

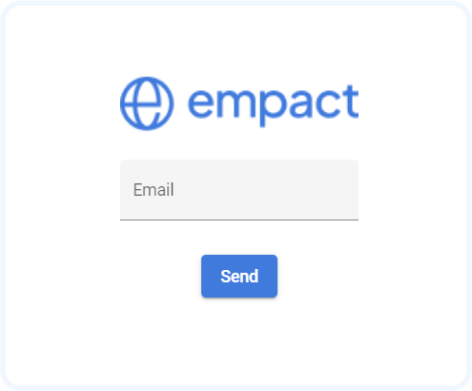

The user shall feed email to get a link to reset the password in its account. The link is sent successfully to an email only in case the email is a registered username in the system.

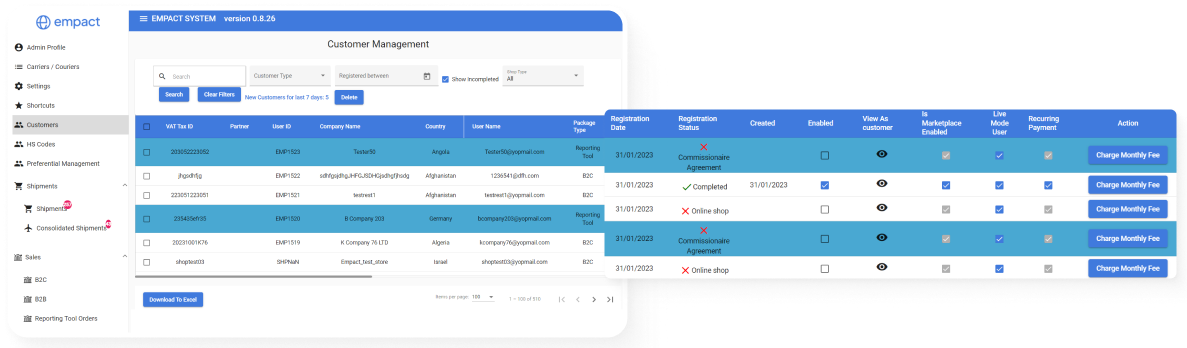

The page shows all customer information as described in the Document Appendix, Customer information data Table.

A bar graph, every bar represents an Order Type, the value of a bar is the total order not in delivered state.

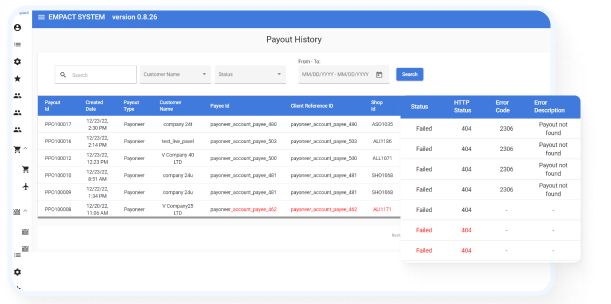

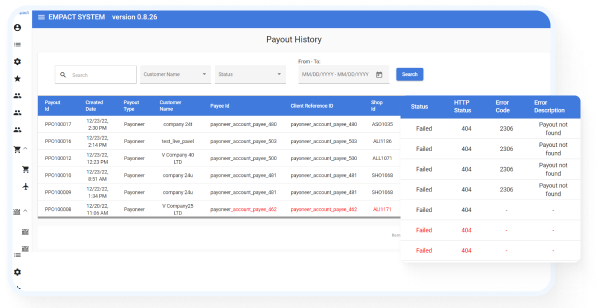

Shows the following data: Total num of orders at payment status: Error. Total amount of all payments in status Error.

A bar graph, every bar represents an Order Type, the value of a bar is the total Amount paid successfully in the last 24 hours for specific type. A bar graph, every bar represents an Order Type, the value of a bar is the total Amount paid successfully in the last 7 days for specific type.

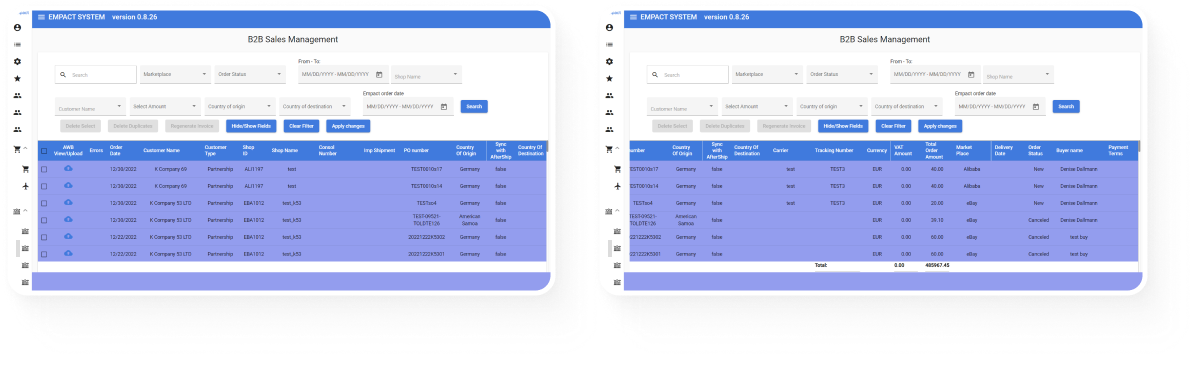

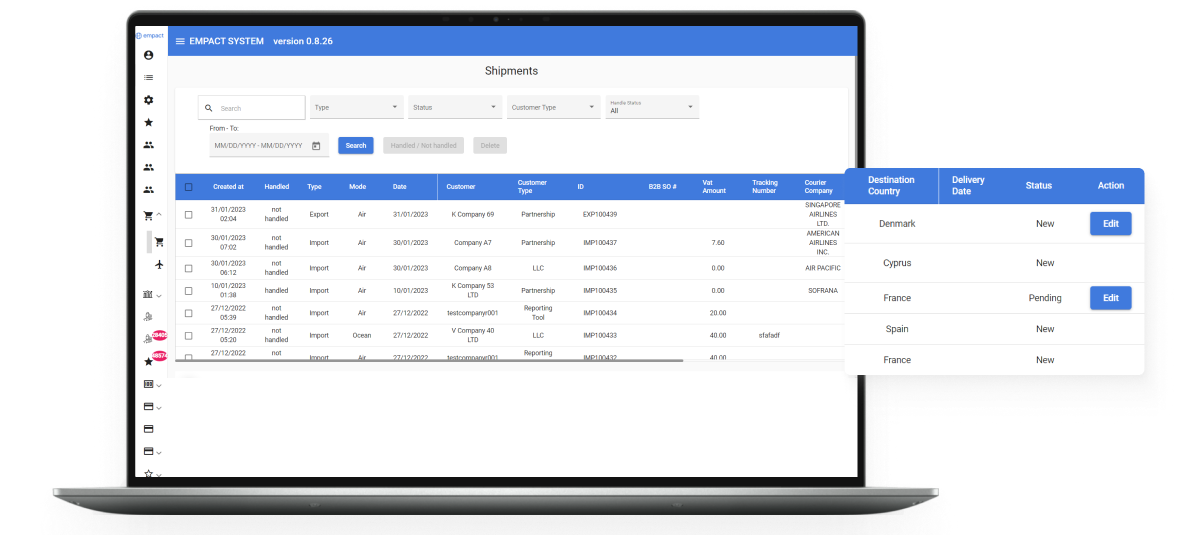

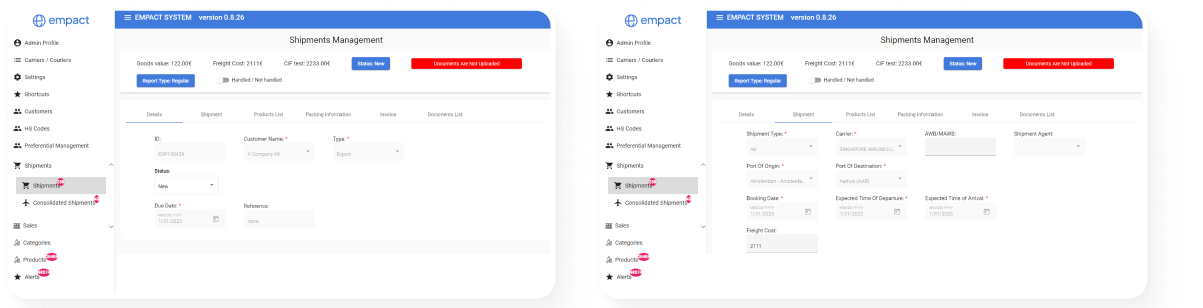

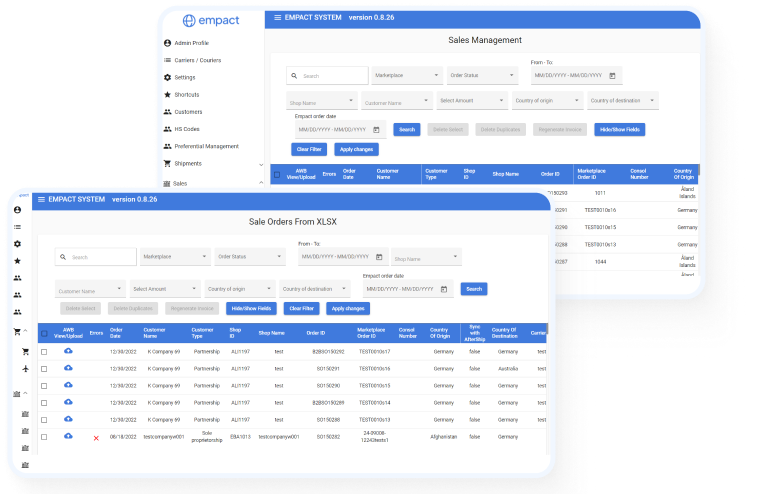

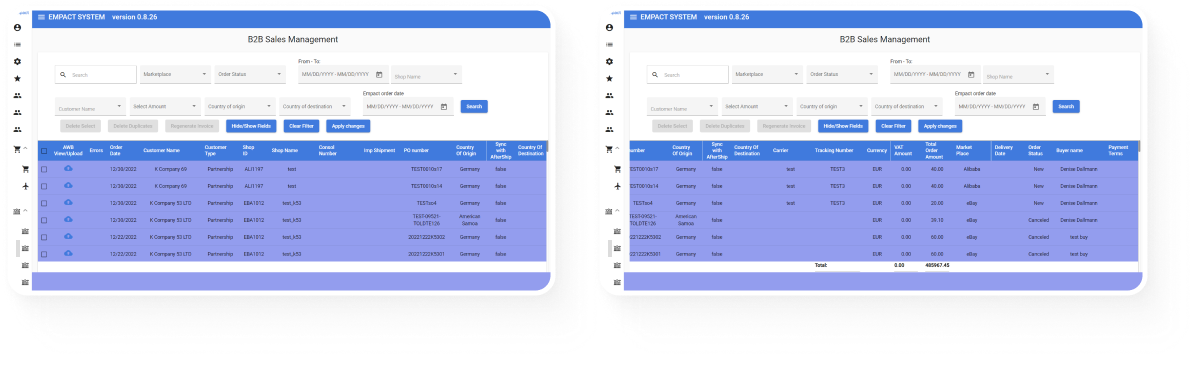

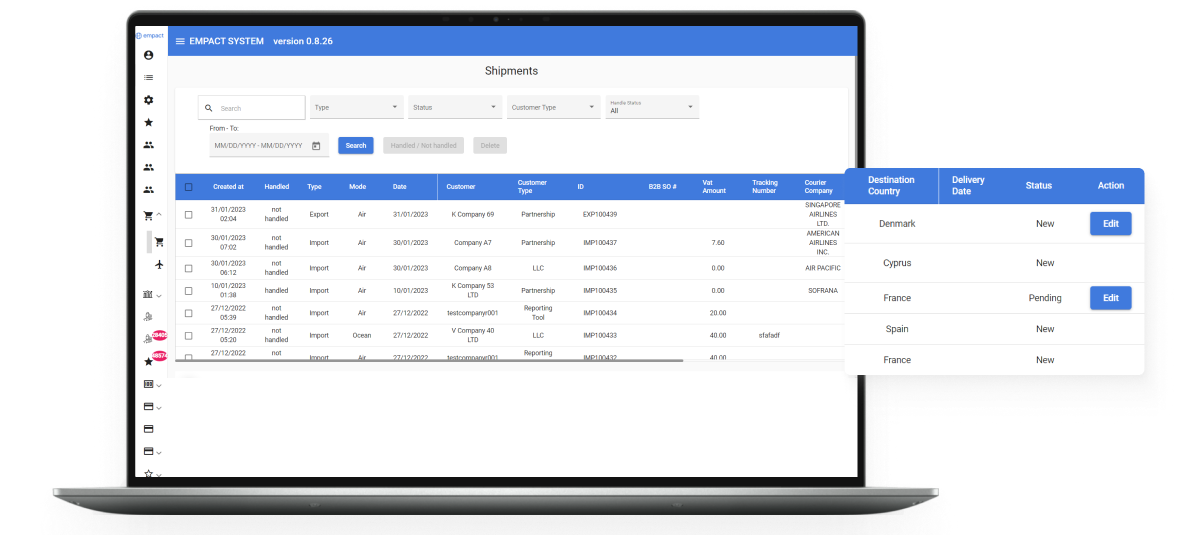

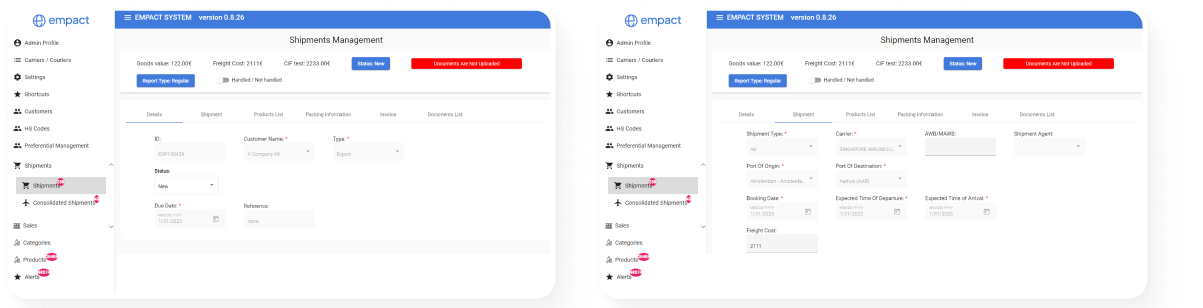

As part of the order creation the system shall get all information regarding the order.

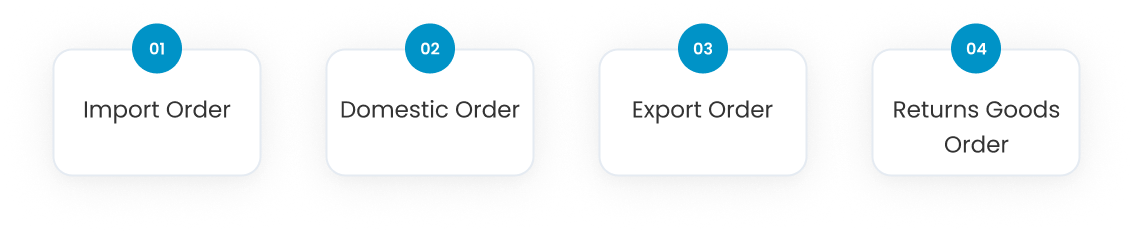

A customer order could have one of the following order types:

A customer order could have one of the following modes:

A GEO location should be assigned to a sell order created in the system so that it can be tracked. The Tracking Number and Carrier type of the goods shipped to the Buyer are included in the Sell Order information that the marketplace shares with Empact. As long as the order is handled by the Carrier, the Empact system uses this information to update the status of the order.

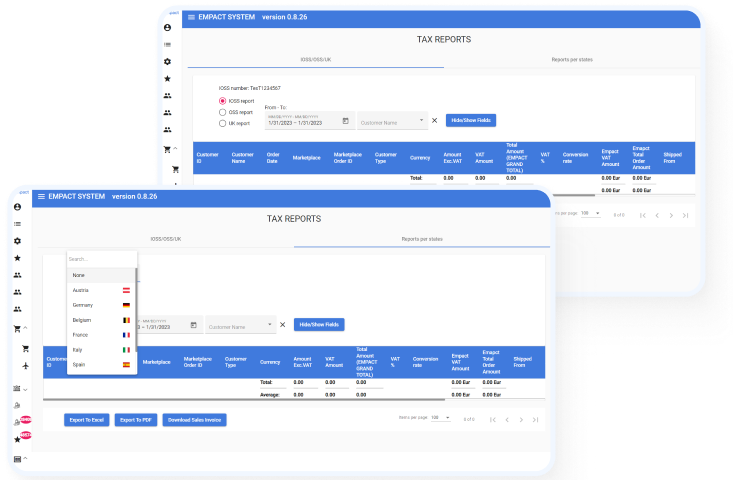

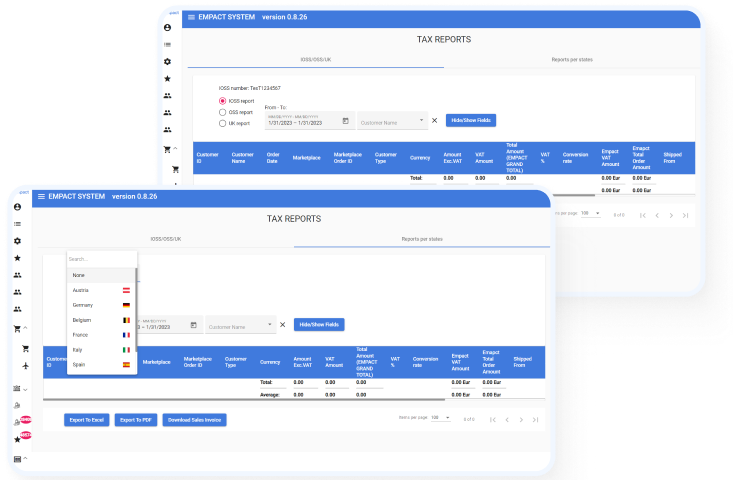

Tax report is a collection of all Orders/Invoices created in the system in a specific period of time. Every line in the report is a summary line for a specific order/invoice.

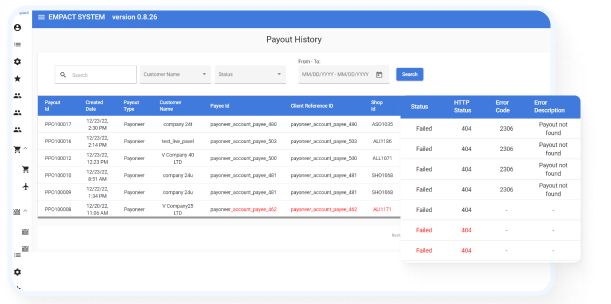

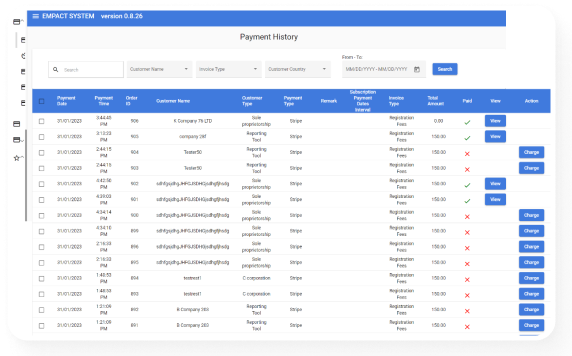

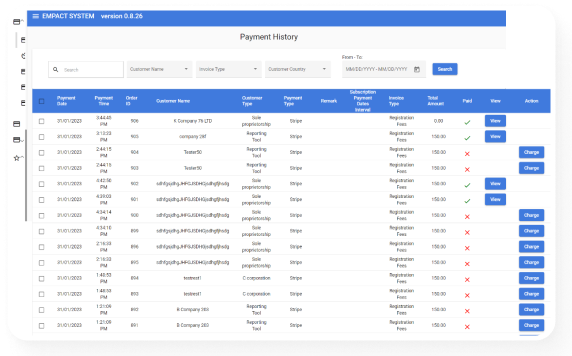

The System integrates two payment gateways to enable payments in the system. The system shall support payments in the system via the following payment options: Paypal Account. Stripe Payment gateway.

Zangula used the colors and fonts as per the company’s standard to make Emapct an aesthetically easy-to-use application.

5 Mobile App Development Trends

We have come a long way since those old apps. Mobile Applica Read more